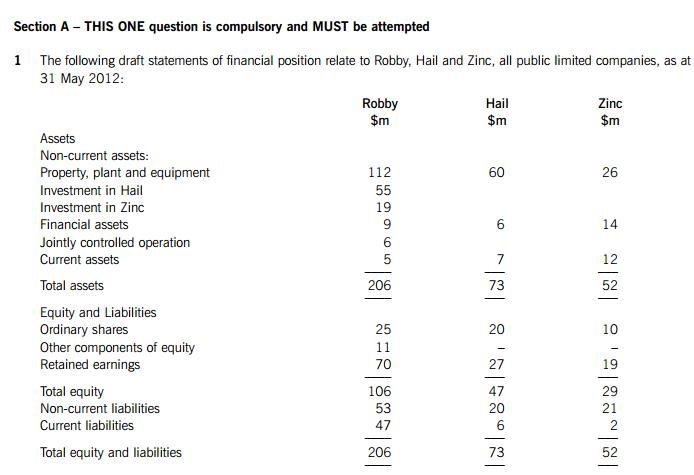

The following information needs to be taken into account in the preparation of the group financial statements of Robby:

(i) On 1 June 2010, Robby acquired 80% of the equity interests of Hail. The purchase consideration comprised

cash of $50 million. Robby has treated the investment in Hail at fair value through other comprehensive income

(OCI).

A dividend received from Hail on 1 January 2012 of $2 million has similarly been credited to OCI.

It is Robby’s policy to measure the non-controlling interest at fair value and this was $15 million on 1 June 2010.

On 1 June 2010, the fair value of the identifiable net assets of Hail were $60 million and the retained earnings

of Hail were $16 million. The excess of the fair value of the net assets is due to an increase in the value of

non-depreciable land.

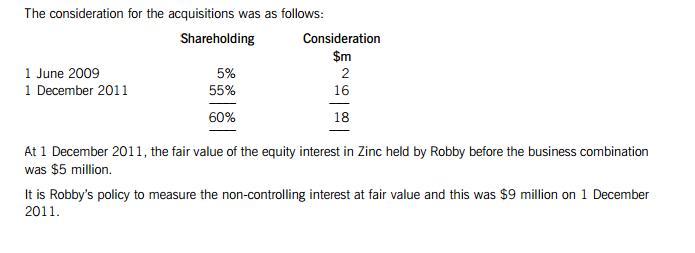

(ii) On 1 June 2009, Robby acquired 5% of the ordinary shares of Zinc. Robby had treated this investment at fair

value through profit or loss in the financial statements to 31 May 2011.

On 1 December 2011, Robby acquired a further 55% of the ordinary shares of Zinc and gained control of the

company

The fair value of the identifiable net assets at 1 December 2011 of Zinc was $26 million, and the retained

earnings were $15 million. The excess of the fair value of the net assets is due to an increase in the value of

property, plant and equipment (PPE), which was provisional pending receipt of the final valuations. These

valuations were received on 1 March 2012 and resulted in an additional increase of $3 million in the fair value

of PPE at the date of acquisition. This increase does not affect the fair value of the non-controlling interest at

acquisition. PPE is to be depreciated on the straight-line basis over a remaining period of five years.

(iii) Robby has a 40% share of a joint operation, a natural gas station. Assets, liabilities, revenue and costs are

apportioned on the basis of shareholding.

The following information relates to the joint arrangement activities:

– The natural gas station cost $15 million to construct and was completed on 1 June 2011 and is to be

dismantled at the end of its life of 10 years. The present value of this dismantling cost to the joint

arrangement at 1 June 2011, using a discount rate of 5%, was $2 million.

– In the year, gas with a direct cost of $16 million was sold for $20 million. Additionally, the joint arrangement

incurred operating costs of $0·5 million during the year.

Robby has only contributed and accounted for its share of the construction cost, paying $6 million. The revenue

and costs are receivable and payable by the other joint operator who settles amounts outstanding with Robby

after the year end.

(iv) Robby purchased PPE for $10 million on 1 June 2009. It has an expected useful life of 20 years and is

depreciated on the straight-line method. On 31 May 2011, the PPE was revalued to $11 million. At 31 May

2012, impairment indicators triggered an impairment review of the PPE. The recoverable amount of the PPE was

$7·8 million. The only accounting entry posted for the year to 31 May 2012 was to account for the depreciation

based on the revalued amount as at 31 May 2011. Robby’s accounting policy is to make a transfer of the excess

depreciation arising on the revaluation of PPE.

(v) Robby held a portfolio of trade receivables with a carrying amount of $4 million at 31 May 2012. At that date,

the entity entered into a factoring agreement with a bank, whereby it transfers the receivables in exchange for

$3·6 million in cash. Robby has agreed to reimburse the factor for any shortfall between the amount collected

and $3·6 million. Once the receivables have been collected, any amounts above $3·6 million, less interest on

this amount, will be repaid to Robby. Robby has derecognised the receivables and charged $0·4 million as a loss

to profit or loss.

(vi) Immediately prior to the year end, Robby sold land to a third party at a price of $16 million with an option to

purchase the land back on 1 July 2012 for $16 million plus a premium of 3%. The market value of the land is

$25 million on 31 May 2012 and the carrying amount was $12 million. Robby accounted for the sale,

consequently eliminating the bank overdraft at 31 May 2012.

Required:

(a) Prepare a consolidated statement of financial position of the Robby Group at 31 May 2012 in accordance

with Hong Kong Financial Reporting Standards. (35 marks)