Section A – BOTH questions are compulsory and MUST be attempted

1 Nente Co, an unlisted company, designs and develops tools and parts for specialist machinery. The company was

formed four years ago by three friends, who own 20% of the equity capital in total, and a consortium of five business

angel organisations, who own the remaining 80%, in roughly equal proportions. Nente Co also has a large amount

of debt finance in the form of variable rate loans. Initially the amount of annual interest payable on these loans was

low and allowed Nente Co to invest internally generated funds to expand its business. Recently though, due to a rapid

increase in interest rates, there has been limited scope for future expansion and no new product development.

The Board of Directors, consisting of the three friends and a representative from each business angel organisation,

met recently to discuss how to secure the company’s future prospects. Two proposals were put forward, as follows:

Proposal 1

To accept a takeover offer from Mije Co, a listed company, which develops and manufactures specialist machinery

tools and parts. The takeover offer is for $2·95 cash per share or a share-for-share exchange where two Mije Co shares

would be offered for three Nente Co shares. Mije Co would need to get the final approval from its shareholders if either

offer is accepted;

Proposal 2

To pursue an opportunity to develop a small prototype product that just breaks even financially, but gives the company

exclusive rights to produce a follow-on product within two years.

The meeting concluded without agreement on which proposal to pursue.

After the meeting, Mije Co was consulted about the exclusive rights. Mije Co’s directors indicated that they had not

considered the rights in their computations and were willing to continue with the takeover offer on the same terms

without them.

Currently, Mije Co has 10 million shares in issue and these are trading for $4·80 each. Mije Co’s price to earnings

(P/E) ratio is 15. It has sufficient cash to pay for Nente Co’s equity and a substantial proportion of its debt, and

believes that this will enable Nente Co to operate on a P/E level of 15 as well. In addition to this, Mije Co believes

that it can find cost-based synergies of $150,000 after tax per year for the foreseeable future. Mije Co’s current profit

after tax is $3,200,000.

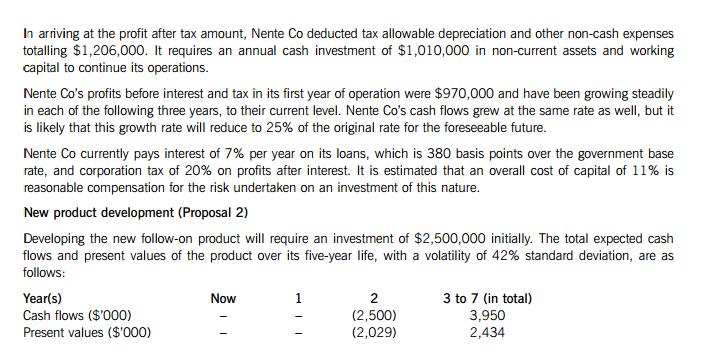

The following financial information relates to Nente Co and to the development of the new product.

Nente Co financial information

Required:

Prepare a report for the Board of Directors of Nente Co that:

(i) Estimates the current value of a Nente Co share, using the free cash flow to firm methodology; (7 marks)

(ii) Estimates the percentage gain in value to a Nente Co share and a Mije Co share under each payment offer;

(8 marks)

(iii) Estimates the percentage gain in the value of the follow-on product to a Nente Co share, based on its cash

flows and on the assumption that the production can be delayed following acquisition of the exclusive rights

of production; (8 marks)

(iv) Discusses the likely reaction of Nente Co and Mije Co shareholders to the takeover offer, including the

assumptions made in the estimates above and how the follow-on product’s value can be utilised by

Nente Co. (8 marks)

Professional marks will be awarded in question 1 for the presentation, structure and clarity of the answer.

(4 marks)

(35 marks)