(b) (i) The basic rules for the derecognition model in HKFRS 9 Financial Instruments is to determine whether the asset under

consideration for derecognition is:

(i) an asset in its entirety, or

(ii) specifically identified cash flows from an asset (or a group of similar financial assets), or

(iii) a fully proportionate (pro rata) share of the cash flows from an asset (or a group of similar financial assets), or

(iv) a fully proportionate (pro rata) share of specifically identified cash flows from a financial asset (or a group of similar

financial assets).

Once the asset under consideration for de-recognition has been determined, an assessment is made as to whether the

asset should be derecognised. Derecognition is required if either:

(i) the contractual rights to the cash flows from the financial asset have expired, or

(ii) financial asset has been transferred, and if so, whether the transfer of that asset is subsequently eligible for

derecognition.

An asset is transferred if either the entity has transferred the contractual rights to receive the cash flows, or the entity

has retained the contractual rights to receive the cash flows from the asset, but has assumed a contractual obligation to

pass those cash flows on under an arrangement that meets the following three conditions:

(i) the entity has no obligation to pay amounts to the eventual recipient unless it collects equivalent amounts on the

original asset;

(ii) the entity is prohibited from selling or pledging the original asset (other than as security to the eventual recipient);

(iii) the entity has an obligation to remit those cash flows without material delay.

Once an entity has determined that the asset has been transferred, it then determines whether or not it has transferred

substantially all of the risks and rewards of ownership of the asset. If substantially all the risks and rewards have been

transferred, the asset is derecognised. If substantially all the risks and rewards have been retained, derecognition of the

asset is precluded. If the entity has neither retained nor transferred substantially all of the risks and rewards of the asset,

then the entity must assess whether it has relinquished control of the asset or not. If the entity does not control the asset

then derecognition is appropriate; however, if the entity has retained control of the asset, then the entity continues to

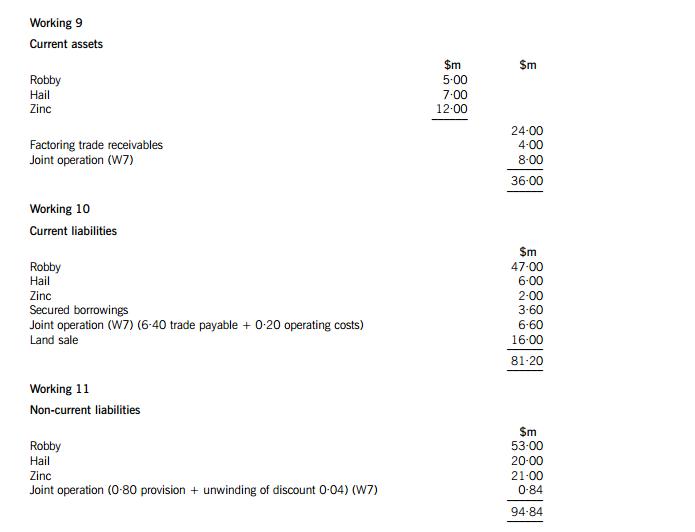

14recognise the asset to the extent to which it has a continuing involvement in the asset. Robby has transferred its rights

to receive cash flows and its maximum exposure is to repay $3·6 million. This is unlikely, but Robby has guaranteed

that it will compensate the bank for all credit losses. Additionally, Robby receives the benefit of amounts received above

$3·6 million and therefore retains both the credit risk and late payment risk. Substantially, all the risks and rewards

remain with Robby and therefore the receivables should still be recognised.